To be shut down or to raise prices: Small and medium businesses face a dilemma

Close the business or raise the price of goods and services? The new tax cuts, effective from January 1, 2025, have put business owners in a difficult situation.

Hripsime Kocharyan has been producing eco-bags for 5 years. The “Ecobag with me” brand, founded in 2020, collaborates with women with young children and children with health issues. First, they teach them sewing and patterning for free, and then they hire them. Currently, they have 12 employees. They all work from home so that they can easily combine work and childcare.

If you’re in a hurry, read this.

“I know, a number of companies will close due to the new tax burden; they didn’t even stand a month. We will not close, because we have an adopted ideology: it doesn’t matter if we don’t generate profit, we must try to provide our mothers with work, this entrepreneurship was created for them, naturally, we strive to generate profit, to have more orders,” says Hripsime Kocharyan.

After its establishment, the production operated as a micro-enterprise, and since 2023, it has been subject to turnover tax. Starting this year, the turnover tax percentage has doubled, which also implies an increase in the price of goods.

“We have not made a difference at the moment, but probably from February-March, whether we like it or not, we will have to increase the cost of each product by 5-10 percent. In the case of 100 pieces, the price of one bag is now 1,970 drams; it will become 2,270 drams.”

According to the entrepreneur, along with the expected inflation, they will face another problem: “If the price goes up, then buyers will look for an alternative option, we will also have a sales problem – a reduction in quantity. As a result of tax increases, we will also have a reduction in the number of employees and working hours.”

According to Hripsime Kocharyan, the tax increases have made women entrepreneurs particularly vulnerable, as they typically have more limited financial resources to invest in their businesses and receive more modest salaries from them.

She also points out that this tax hike was implemented without prior consultation with representatives of small and medium-sized enterprises (SMEs): “They make the decision first and only then consider the opinions of SMEs. It’s not that SMEs don’t want to pay taxes, but those taxes need to be realistic.”

As a result, not only are small and medium businesses facing serious challenges, but price increases are also expected — the rise in taxes will directly affect the wallets of end consumers.

New tax changes

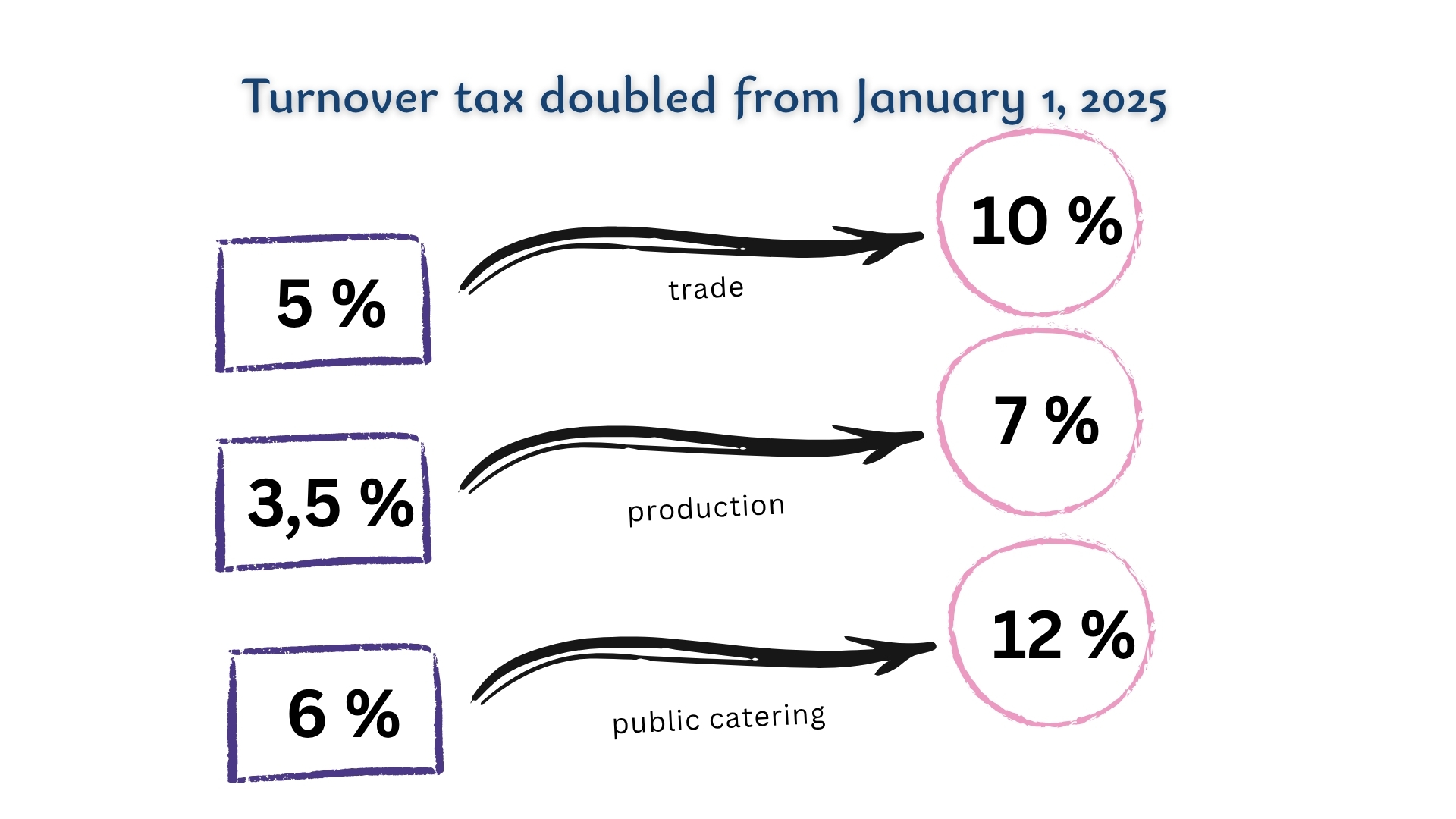

According to the amendments made to the Tax Code, the turnover tax rate has doubled since the beginning of this year.

Accordingly, in the case of trade, the tax has been set at 10% instead of the previous 5%, in the case of production – 7% instead of the previous 3.5%, in the case of the public catering sector – 12% instead of the previous 6% (Tax Code, Article 258).

With the same changes, a number of sectors operating under turnover tax have also begun to operate in the general taxation field. From January 1, providers of advocacy services have been transferred to the value-added tax (VAT) field, and from July 1, 2025, companies providing accounting, legal services and financial consulting operating in the turnover tax field are scheduled to be transferred to the VAT field.

At the same time, a number of types of activities can no longer continue to operate as micro-enterprises and be exempt from taxes, they have also moved to the turnover tax field. This particularly concerns commercial activities in the regions, hairdressing, body care, saunas, steam baths, car maintenance and repair services, intermediary activities – real estate rental and sale, etc.

Business Taxation Regimes in Armenia

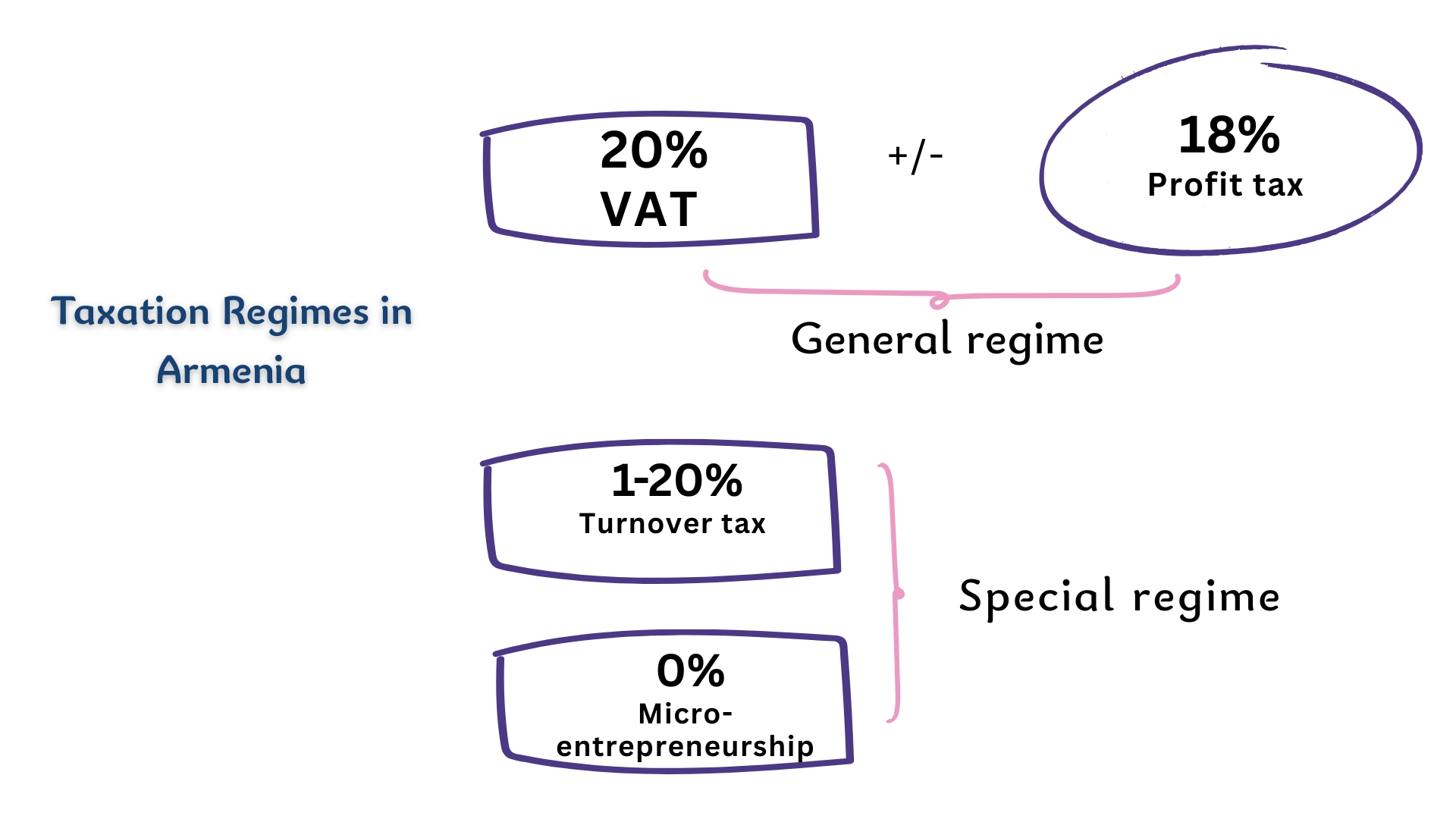

In Armenia, businesses operate under general and special taxation systems or regimes. Those operating under the general taxation system are taxed by VAT and/or profit tax. VAT is calculated at a rate of 20 percent, and profit tax at a rate of 18 percent as a general rule (with some exceptions, the rate may be different). That is, in cases where a business pays both VAT and profit tax, the monthly tax payments are 38 percent.

There are two special taxation systems: micro-entrepreneurship and turnover tax regime. In the case of turnover tax, taxes are calculated at a rate of up to 12 percent, depending on the type of activity. In the case of micro-entrepreneurship, individuals are exempt from all types of tax obligations.

All businesses, at the same time, depending on the nature of the activity and other factors, may pay different taxes and fees, for example, environmental tax, road tax, excise tax, etc.

All businesses with employees pay income tax and stamp duty.

Small and medium-sized businesses are targeted

The president of the Small and Medium-sized Enterprises Association, Hakob Avagyan, also says that the consequences of raising taxes and reducing privileges (in particular, removing certain types of activities from the micro-enterprise taxation regime) will be the closure of some businesses and the inflation of goods.

“We talk to regional small and medium-sized entrepreneurs, and they say, no, they have imposed such a burden that is unbearable, we, on the contrary, will go into hiding. In other words, the same tax forecast: 13 billion with one project, 18 billion with another project, additional income will be provided with one project, but that will not be provided either. Because people say, we cannot pay, because it is an unbearable burden.”

According to him, the relevant structures should also have made forecasts regarding the risks of the changes being made. “In other words, the Ministry of Economy should have made that prediction, then written an opinion for those laws. We have had experience working with the previous three governments, and this is the first time I see that they write, ‘I am not against’, to draft laws containing norms that will worsen the situation for small and medium-sized businesses. Therefore, we have what we have.”

As for the government’s observation that micro-entrepreneurship privileges lead to the fact that small businesses do not grow or at some point the increase in turnover is inhibited, Hakob Avagyan notes that small businesses are created and closed all over the world. Some succeed, expand, some close, and some simply decide that this level of development and expansion is enough for them, they consider themselves a “boutique business”.

“That is, it is not a crime when a small business says, I want to stay within this threshold, or when it decides to increase the volume of business.”

Avagyan also spoke about the change to exclude regional stores from the field of micro-entrepreneurship. In particular, according to him, more than 50 percent of SMEs are traders, and small stores operating in border villages and communities actually play a much more important role than just being a store.

“Let’s not forget that the phenomenon of lending goods still exists: one person is given bread on credit, another is given child care on credit… The only hairdresser and dental clinic operating in the region are of equal importance. In other words, to say in such a hasty manner and without deep research that we are eliminating micro-entrepreneurship is wrong, because tax policy leads to balanced economic development, poverty reduction, job creation, etc.”

Either bankruptcy, or emigration, or transition to the shadow economy: economist

“Tax collection has become the main indicator of efficiency for this government. The more taxes it collects, the more the corresponding bonuses increase. Starting from 2018, tax revenues have increased by an average of 15.6 percent every year until 2023, compared to 2014-2018. The growth has been about 5 percent each year. This leads to the fact that SRC employees are not becoming assistants to the economy, but on the contrary, they are interested in collecting taxes from everywhere and placing an additional burden on business entities,” says economist Aghasi Tavadyan, head of the Tvyal.com organization.

According to him, for the first 9 months of 2024, about 8 percent less tax was received by the state budget than was planned by the government. “This is unprecedented, nothing like this has been recorded in the last 20 years. This speaks of the wrong fiscal policy and that this policy is no longer working. In reality, the economy cannot pay additional taxes. Business operators will either exit the market, declaring themselves bankrupt, or go abroad, where the tax policy is more favorable, or they will go into the shadows.”

Government Response

We attempted to obtain a response from the government, specifically the Ministry of Economy and the State Revenue Committee, as to whether the above-mentioned risks have been assessed and whether measures to mitigate them have been planned.

We received the following response from the Ministry of Economy: “In order to alleviate possible risks and concerns of businessmen, the government has developed and is implementing numerous targeted support measures in the form of state support tools of the Ministry of Economy. One of them was adopted just last week, through which we will provide support to companies engaged in export activities, they will be able to use our programs, they will receive certain subsidies. We have other “state support” programs for private business companies, it can be our program for attracting highly qualified specialists, the leasing program, through which they can borrow equipment at 0 interest rates, etc. The list of these programs is large, they can support businesses to avoid closure and be able to increase their turnover. In other words, in essence, privileges are not being reduced, but expanded, a vivid proof of this was the adoption of another support program by the government last week.”

By the time of publication of the article, we had not received a response from the State Revenue Committee.

Author: Arpine Simonyan

The material was prepared within the framework of the “Support to Women Entrepreneurs” program by the “Ket 33” NGO with the support of the Embassy of the Kingdom of the Netherlands in Armenia. The author is solely responsible for the content of the material, and the views expressed therein may not coincide with the views of the Ambassador.